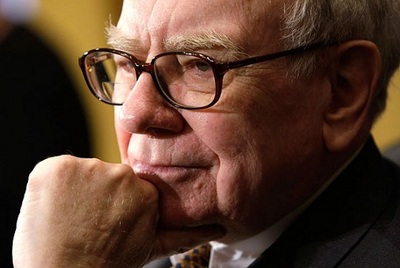

WARREN BUFFETT is the billionaire CEO of Berkshire Hathaway, a friend and political supporter of Barack Obama, and a well-known advocate of higher taxes on the rich. He is also a hypocrite, whose actions belie his words.

For several years now, Buffett has been calling for significant tax hikes on extremely wealthy Americans like himself. Last week, in a New York Times column headlined "Stop Coddling the Super-Rich," Buffett lamented that the $6,938,744 he forked over in federal income and payroll taxes in 2010 amounted to just 17.4 percent of his taxable income. "What I paid," the world's most famous investor observed, "was . . . actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent, and averaged 36 percent."

Buffett has not made his employees' tax returns public, but the federal tax burdens he ascribes to them appear to be highly atypical. According to the Congressional Budget Office, the overall federal tax load shouldered by Americans -- comprising income, payroll, corporate, and excise taxes -- is quite progressive. CBO reported last summer that "households in the bottom fifth of the income distribution paid 4.0 percent of their income in federal taxes, the middle quintile paid 14.3 percent, and the highest quintile paid 25.1 percent. Average rates continued to rise within the top quintile: The top 1 percent faced an average rate of 29.5 percent." If Buffett's numbers are right, his employees must be among the highest-taxed workers in America.

Yet Buffett doesn't argue that his workers' federal taxes should be cut. He demands that his own be raised.

As many critics have noted, Buffett can voluntarily send Washington more money than he owes in taxes. Anyone can. Since 1843, the Treasury Department notes on its website, the government has maintained an account "to accept gifts, such as bequests, from individuals wishing to express their patriotism to the United States." Deposits to that account are added to the government's general fund, but the feds also accept contributions -- by credit card, electronic payment, or check -- specifically earmarked for paying down federal debt.

It would be nice to think that those who insist so vehemently that Washington's debt crisis cannot be resolved without higher revenues are taking the lead and freely reaching into their own pockets. Alas, no. Donations to the Bureau of the Public Debt, The New York Times reported last year, only trickle in at an annual rate of about $2 million to $3 million.

What makes Buffett a hypocrite isn't that he champions an immediate tax increase on the wealthy, yet donates nothing extra to Washington himself. Merely favoring a change in the law doesn't oblige anyone to act as if the change has been enacted.

But Buffett doesn't just propose higher taxes on millionaires and billionaires as a matter of abstract policy. He argues that he personally (along with what he calls "my mega-rich friends") has been "spared" any shared sacrifice, that he personally has "been coddled long enough," that he personally shouldn't get "extraordinary tax breaks" when so many Americans are struggling. He frames his call for higher taxes as an avowal of his own moral obligations. Were he to put his money where his mouth is and voluntarily send the Treasury a big check, his call for higher taxes would carry greater moral authority. His failure to do so is not just intellectually inconsistent, it's hypocritical.

Buffett isn't greedy. He is an extraordinary philanthropist who has undertaken to give 99 percent of his immense fortune to charity, and who, with Bill Gates, actively encourages other billionaires to spend down half or more of their wealth in charitable donations.

And why is he giving all that money to charity instead of to Uncle Sam? Because, as he has said in interviews, he knows it will do more good that way and be used more effectively. Who would disagree? For all Buffett's talk of being undertaxed, he believes what nearly everyone believes -- that he can allocate his money more wisely than the government. And not just that he can, but that he should.

When the Sage of Omaha calls for higher taxes, his words get plenty of attention. But his actions speak louder, and convey a markedly different message.

(Jeff Jacoby is a columnist for The Boston Globe).

-- ## --

Follow Jeff Jacoby on Twitter.

Discuss his columns on Facebook.

Want to read more? Sign up for "Arguable," Jeff Jacoby's free weekly email newsletter.